Advantages and Disadvantages of Mergers and Acquisitions

There are many advantages and disadvantages to sensitivity analysis as follows. Likewise the company also added customers and target.

Mergers And Acquisitions 2 0 Youtube

Here are some of them.

. First growth is faster. Inorganic growth has some advantages over organic growth. In this form an entity launches new products or services that.

Merging companies or acquiring another company can bring a number of benefits to those involved with the business. When sensitivity analysis is done each independent dependent variable is studied in. Considering selling a business.

Floating on the stock market. Some advantages relate to how the business can interact with and serve its customers while others improve efficiencies for employees. In a concentric diversification strategy the entity introduces new products with an aim to fully utilize the potential of the prevailing technologies and marketing system.

Following are the advantages of this analysis. For example a bakery making bread starts producing biscuits. In mergers and acquisitions companies combine two different production facilities to increase scale and operating capacity more rapidly.

You may want to use the services of a contractor or subcontractor for this although it is important to weigh up the advantages against the disadvantages of contracting and subcontracting. Advantages of mergers and acquisitions. Business acquisitions and mergers.

Disadvantages of mergers and acquisitions. Advantages of Sensitivity Analysis. Advantages and disadvantages of external growth.

Advantages And Disadvantages Of Merger And Acquisitions Youtube

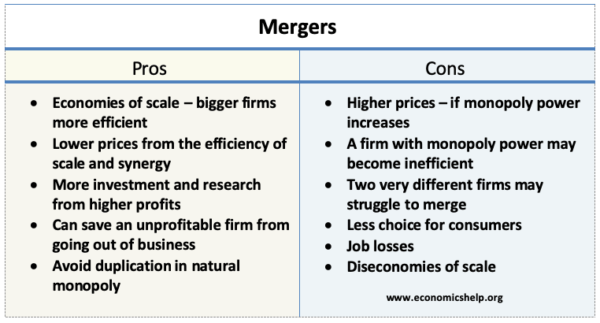

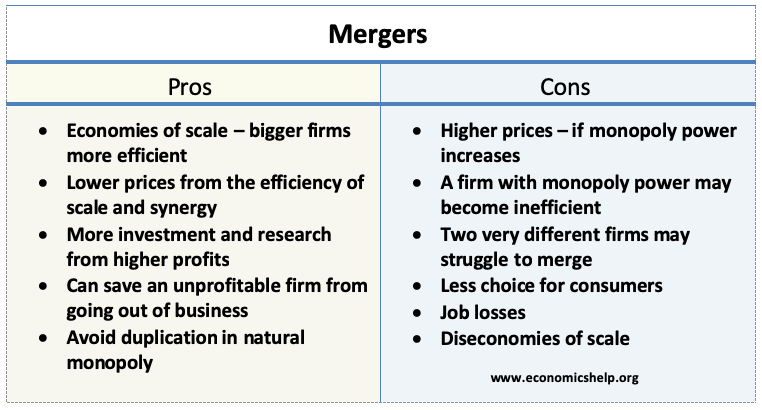

Pros And Cons Of Mergers Economics Help

Comments

Post a Comment